Read on to find out what we’ve learned about PIX from real customer data

What we’ve learned about the future of PIX from analyzing 2 months of client data

Going through our client data has given us some pretty fascinating insights into Brazilian consumer behaviour with regards to the new PIX payment method. Here’s the big one – even though our merchants have been offering PIX alongside Boletos for just a few weeks, 46% of our clients are choosing PIX over the more established cash-based Boletos. That’s right – nearly half of all non-credit purchases are going via PIX, despite how new it is.

Our prediction is that this trend will continue, as more customers switch from Boletos to PIX. We also believe that PIX will begin to replace other payment methods, like debit cards, wire transfers, and credit card transactions, as time moves on.

Want to know why? Click the button below to download and watch our webinar on the future of PIX:

What does the future hold for PIX?

A promissing outlook

- Brazilian Market:

- Over 130 million online shoppers.

- More smartphones than population.

- Over 90% of the national territory with 4G technology.

- Mobile-first, internet-savvy, educated consumers.

- Growth of contactless payment

Roadmap from the Brazilian Central Bank:

– Recurring payments

– Reach the unbanked

PIX has the potential to become a faster and cheaper alternative to:

– Debit cards;

– Non-instalment credit card purchases; and

– Bank Transfer (TED/DOC)

PIX is a great option for merchants

- Because shoppers only need a mobile phone to use PIX, restrictions on international use of Brazilian credit cards are a thing of the past.

- PIX is also cheaper for merchants than credit card processing – no card schemes means lower processing fees.

- And of course, merchants will be pleased to know that PIX purchases mean that they will receive the funds from their Brazilian customers immediately, with no FX risk or anticipation fees.

Added to that, market drivers had a clear impact on the success of the PIX launch. Of course, COVID-19 had driven huge swathes of the population online. The Brazilian consumer was calling out for greater payment innovation, and the Central Bank did a fantastic job at generating a buzz about their latest experiment.

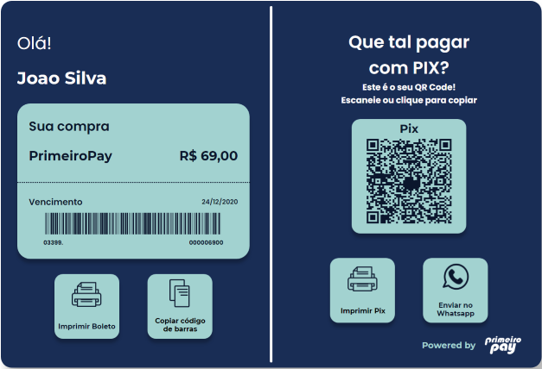

Realizing that PIX was going to be huge, we were keen to make sure that our clients could offer their customers PIX as a payment option from Day 1. We set up a hybrid payment model, which allows our merchants to offer their customers PIX alongside their usual Boleto option – with no need for any extra integration.

If you’d like to learn more, then hurry – our recent webinar on all things PIX is available for download on our website for a limited time only. In the webinar, our International Business Development Manager, Pedro Azevedo, has summarized all our insights from 2 months of customer data to bring you a comprehensive view of the impact of PIX on Brazilian ecommerce – and where we think it will be going in the future. If you’re selling, or planning to sell, online in Brazil in 2021, this is pretty much a must-see!