CoDi is a digital payment method from Mexico based on QR codes and NFC technology

How does CoDi work?

CoDi lets users make purchases via a wire transfer from their bank account. The user either scans a merchant’s QR code, or uses an NFC-enabled terminal, and then authorizes the payment via their cell phone. CoDi can be used for any purchase up to a value of MXN8000 (roughly USD380). Transactions are free of charge.

How does CoDi compare to Mexico’s other popular payment methods?

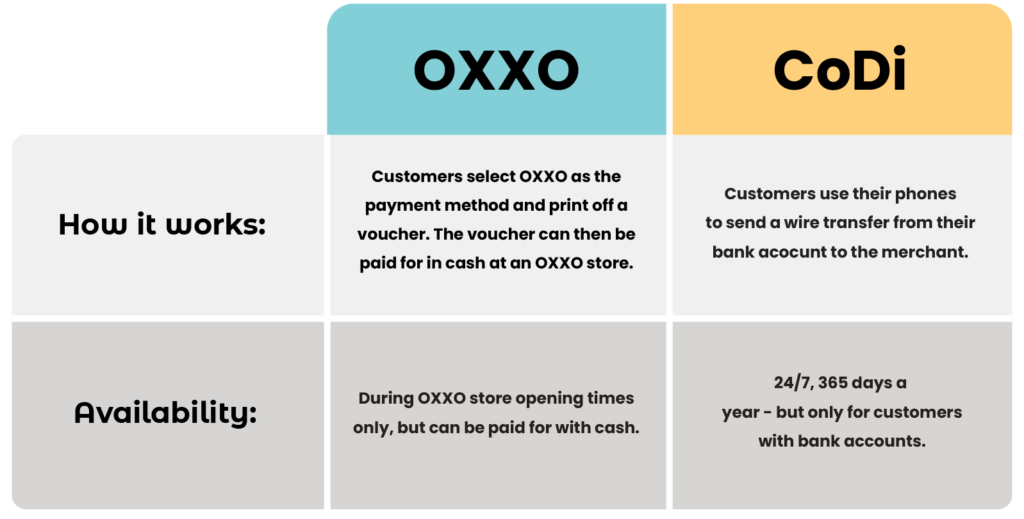

CoDi – v- OXXO

OXXO vouchers are one of the most popular payment methods in Mexico, with up to 18% of the payments market. Customers select OXXO as their payment method online, then print off their OXXO voucher and take it to an OXXO store to pay in cash. Once the voucher has been paid for, their online purchase will be processed.

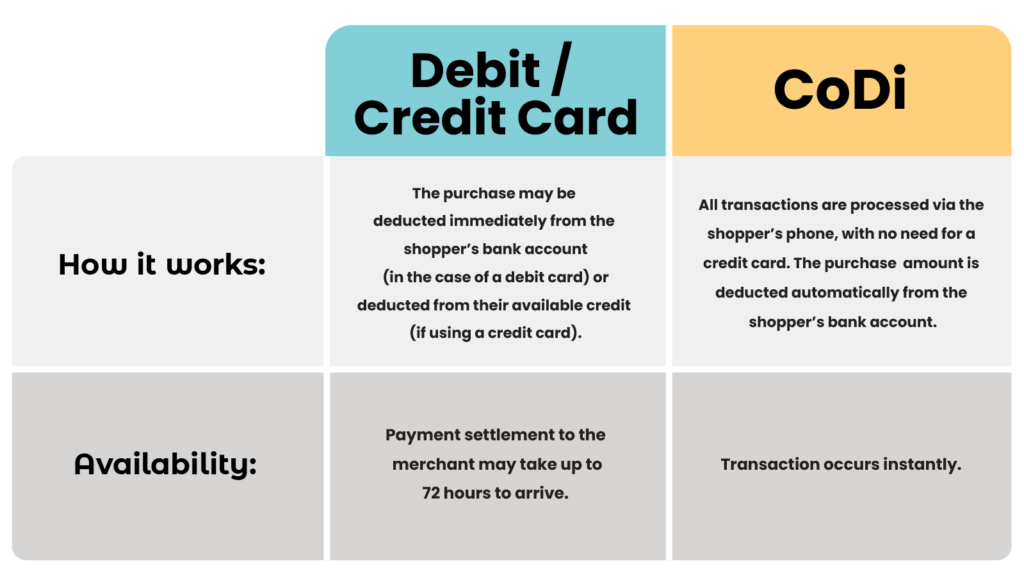

CoDi – v- Credit Card

Credit cards are less widely used in Mexico than in more established markets such as North America or Europe. In Mexico, debit is king, representing 70% of purchases. Even those customers with cards may not be allowed to use them for international purchases, such as online shopping with businesses based outside Mexico.

The Objectives of CoDi

CoDi uptake in Mexico was somewhat slower than expected, but is now gaining ground. A total of 38 banks in Mexico have authorized CoDi for their customers. Every financial institution in Mexico with more than 3,000 clients is required to offer CoDi.

The aim of CoDi was to help transition Mexico from a primarily cash-based society to a cashless economy, one of the stated objectives of the current government. At the moment, many Mexicans still pay for everything from transportation to rent in cash. By enabling users to make purchases via their phones, the Bank of Mexico hoped to take advantage of the huge popularity of mobile technology in Mexico – 89% of Mexican consumers had a mobile phone connection in 2020, and the number continues to grow. The Bank also hopes that by offering an easy, quick payment method for smartphone users, CoDi may also encourage the many unbanked Mexican consumers to open a bank account.

The Advantages of CoDi for Merchants

For merchants, the advantages of CoDi are clear: :

- They will receive the payment settlement within 30 seconds. As a result, CoDi protects the merchant from failed payments, fraud, and delayed payments.

- CoDi allows them to sell to a far wider customer base than a card-only payment system, by opening up digital purchasing to customers with no credit card.

- CoDi is fast, easy and contactless, making it ideal for ecommerce businesses.

If you have any questions about CoDi or other payment methods in Mexico, our team of international payments experts are here to help. Please click here to contact us – we’d love to hear from you!