Surrounded by a lot of buzz and promises of a revolution in the Brazilian payment industry, we’ll tell you what PIX is and how it compares to other local payment methods

Pix is an electronic method to make payments and to transfer money developed by the Central Bank of Brazil (BCB) that will work 24/7 including weekends and public holidays.

There are a lot of rumours about this instant payment system: it will be the biggest contestant yet for cash-based method Boleto; it will reduce the usage of credit cards in online shopping; it will crush the traditional bank transfer procedure (popularly known as TED). But will it do all those things?

Instead of rushing into answering those questions, let’s break down all these local methods mentioned above, so you can learn how PIX will impact your business from the 16th of November.

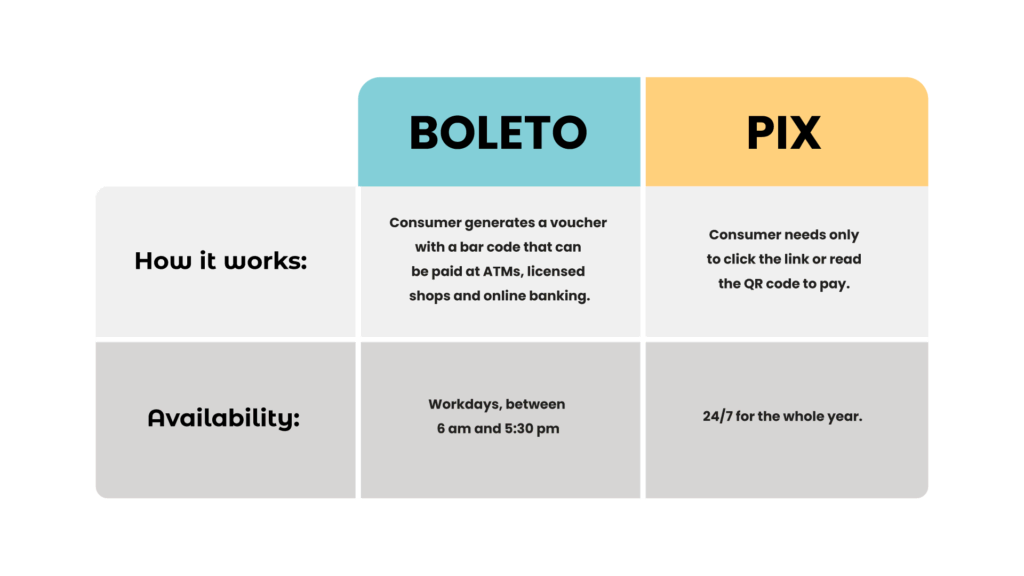

Boleto Bancário

The Boleto is Brazil’s most popular Business to Consumer cash-based method. In an online market of more than 150 million purchases per year, Boleto represents 25% of payments. Its popularity is mainly due to safety and to the number of unbanked people in the country.

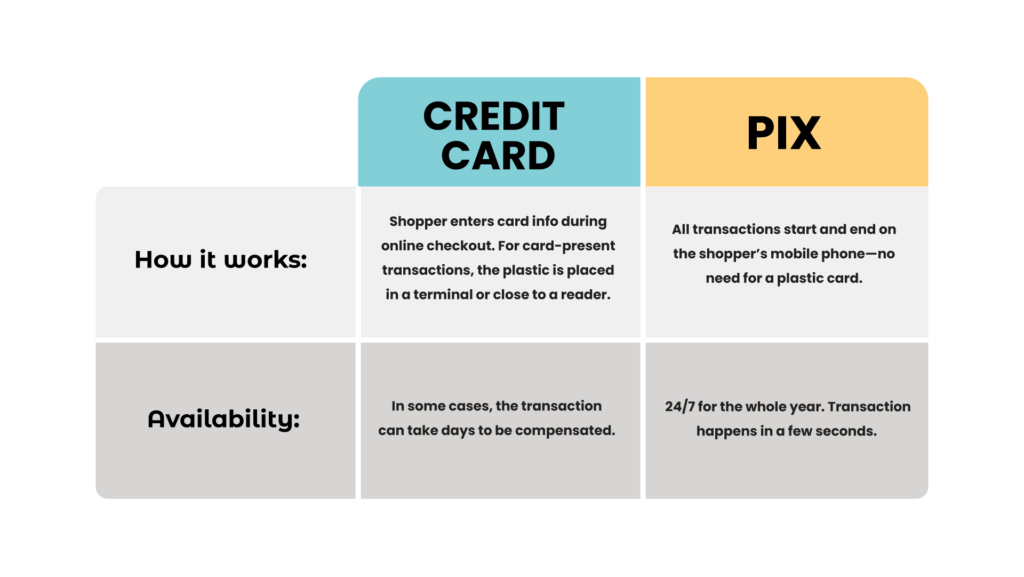

Brazilian credit cards

Pix’s advantages over credit cards are that the end-user will not be charged a user fee, like the annuity practised by issuing Banks. Consumers are also bound to a limit of credit offered by Banks, while PIX payments are not a credit operation. For the merchant, the main difference will be the settlement period. In Brazil, businesses receive funds after 30 days after the purchase; if, on the other hand, they want to receive the amount before that, they need to pay an “anticipation fee”.

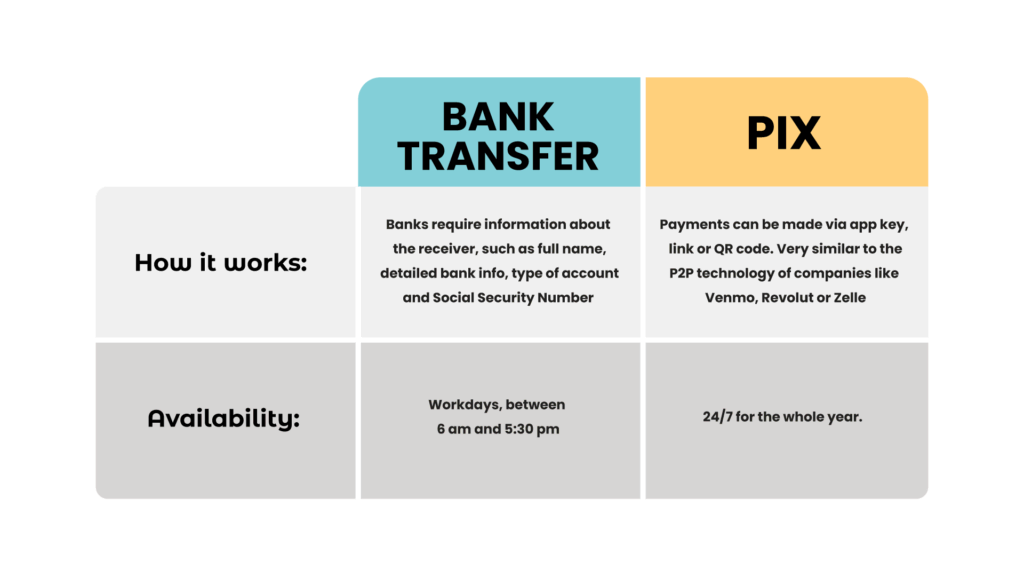

DOC/TED

Bank transfer between individuals or legal entities, DOCs and TEDs are only processed during working weekdays, during a limited period of hours. Contrary to cash-based bank deposits, a bank account is required to both send and receive money.

Now, let’s focus on PIX

Not even Covid-19 is slowing down the efforts of the Central Bank of Brazil to push forward their Agenda BC# of innovations, focused on the four pillars of inclusion, competitiveness, transparency and education. Launching their instant payment scheme is no exception. In August, the BCB announced that PIX regulation was in place, and its debut to the public is planned for November 2020.

To foster competition and maintain neutrality, the BCB will be the sole responsible for its implementation, regulation, data management and settlement infrastructure. According to the BCB, this centralisation aims to guarantee a simple and intuitive user experience, with options for carrying out transactions that are easy to find, safe, with clarity of language, agile, precise, transparent and convenient. All PIX participants will need to observe these rules.

Transactions will be transmitted in up to 10 seconds, 24h a day, including weekends and holidays. To start a payment, users can create an account with personal data such as telephone number, e-mail or social security number; or generate a QR code (a single one or one per operation).

The solution now is on the registration phase for financial institutions and fintechs. It will soon be available for your e-commerce to add it to your local online payment mix.

How can we help?

Our payment experts are ready to answer all your PIX-related question: expectations, regulations, international payments settlements. Or whichever other doubts you have in mind.